| 오늘 금값(금시세) 주홍철 기자 jhc@kjdaily.com |

| 2023년 12월 19일(화) 07:10 |

|

-오늘의 금시세(한국금거래소 0.55%↑)

18일(미국 현지시간) 국제 금값이 소폭 상승했다. 美 달러화와 국채금리 하락, 홍해의 지정학적 리스크가 금가격을 끌어올렸다.

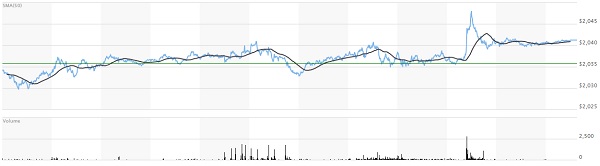

월요일(현지시간) 뉴욕상품거래소에서 내년 2월물 금 가격은 전일 대비 4.8달러(0.23%) 상승한 온스당 2,040.50달러에 거래를 마쳤다. 금시세는 2거래일 만에 반등했다. 장중 금가격은 2,029.50~2,048.00 레인지 내에서 움직였다. 지난주 美 연준의 피벗 공식화 이후 달러화가 전반적 약세를 보이면서 금값은 4거래일째 심리적 지지선인 2천 달러선을 유지하고 있다.

이날도 달러화와 국채 금리가 하락세를 나타내며 금가격이 올랐다. 지난주 美 연준의 비둘기파적 기조 전환 여파가 달러화와 국채 금리 약세를 부추킨 것으로 풀이됐다.

주요 6개 통화에 대한 달러 가치를 반영하는 달러 인덱스는 전장보다 0.15% 하락한 102.452를 기록했다. 10년물 국채금리는 전 거래일보다 내린 3.913%를 기록했다. 통화정책에 민감한 2년물 금리는 4.425%, 30년물 국채금리는 0.54bp 떨어진 4.025%에 거래됐다.

달러화와 국채수익률 하락은 금가격의 우호적인 요인이다. 통상 달러화로 거래되는 금의 체감가격을 낮춰 해외바이어들의 매수심리를 자극하고, 금을 보유하는 데 대한 기회비용을 낮추기 때문이다.

|

홍해 지역의 지정학적 위기도 안전자산 금 매수세로 이어졌다. 이스라엘과 하마스의 전쟁에 개입하려는 의도로 예멘 반군 후티가 홍해에서 민간 선박을 연쇄적으로 공격했다고 이날 외신들이 보도했다. AFP 통신 등 외신에 따르면 이란과 우호적인 예멘 반군 후티는 성명을 통해 "예멘군(반군)은 해상 드론을 이용해 시온주의자(이스라엘) 당국과 관계된 선박 2척에 대한 군사작전을 수행했다"고 말했다. 아시아와 유럽을 잇는 주요 항로인 홍해에서 민간 선박을 겨냥한 예멘의 친이란 반군 후티(Houthi)의 공격이 거세지면서 유가에도 영향을 줄 우려가 커지고 있다.

Kitco Metals의 수석 애널리스트 짐 와이코프(Jim Wyckoff)는 "귀금속 시장은 다음 주요 경제지표나 뉴스를 기다리며 숨고르기에 들어갔지만 금 트레이더들 사이에서는 기술적 강세와 함께 저가 매수 심리가 작용하고 있다"고 설명했다. 이어 그는 "금시세가 계속 유지하는 근본적인 요인은 미국 달러 약세, 주요 중앙은행, 특히 연준의 완화적 통화정책, 중동 긴장 고조로 인한 안전자산 수요"라고 덧붙였다.

투자자들은 오는 금요일에 발표되는 11월 핵심 개인소비지출(PCE) 지표를 비롯해 이번주 주요 경제데이타를 기다리고 있다.

20일 미국 콘퍼런스보드 소비자신뢰지수와 영국 소비자물가지수가 발표된다. 오는 21일엔 필라델피아 연은의 12월 제조업지수, 22일엔 12월 내구재주문과 함께 연준이 가장 주목하는 물가지표인 개인소비지출 PCE의 11월 지표가 함께 공개된다. 경제 지표와 함께 현재 진행형인 중동 전쟁도 살펴봐야 할 대목이다.

한편, 은 가격은 0.047달러(0.19%) 하락한 온스당 24.154달러를 기록했다. 반면 구리는 전날 대비 1%(0.0385달러) 가까이 하락한 3.8520달러에 거래를 마쳤다.

이 시각 국제 금시세(오전 9시 50분 기준, 런던 LBMA 금값시세)는 2,026달러 선에 움직이고 있다.

지난주 중반이후 하락과 보합을 반복하던 국내 금가격은 4거래일 만에 반등했다. 국제 금값과 원/달러 환율 상승 등의 영향에 따라 국내 금가격은 19일 오전 소폭 상승했다.

이날 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.55% 오른 363,000원(VAT포함)이다(오전 9시 50분 기준).

소비자가 순금 1돈 팔때 가격은 전장 대비 0.32% 오른 316,000원이다. 18k, 14k 팔때 가격도 각각 232,300원, 180,200원으로 전 거래일 대비 각각 0.3% 이상 올랐다(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일과 같은 4,390원, 팔때는 3,490원을 나타냈다. 백금 살때 가격은 168,000원, 팔때 가격은 141,000원으로 전일 대비 각각 0.6%, 0.71% 상승했다.

한국거래소(KRX)와 신한은행 금시세도 오름세를 보이며, 1㎏짜리 금 현물의 1g당 가격은 8만5천원 안팎에 거래되고 있다.

오전 9시 50분 기준, 한국거래소(KRX) 금 가격은 전일 종가 대비 0.37% 오른 g당 85,100원을, 신한은행 금가격은 0.18%(149.82원) 오른 g당 84,855.85원을 나타내고 있다.

서울 외환시장에서 원·달러 환율은 전 거래일보다 5.30원 상승한 1,302.50원으로 장을 출발했다.

자세한 일일 금값시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

뉴미디어부 주홍철 기자 jhc@kjdaily.com

-아래는 위 기사를 영어로 번역한 영문 전문이다. 기사 번역에 다소 오류가 있을 수 있다

-18th international gold price 0.23%↑

-Today’s gold price (Korea Gold Exchange 0.55%↑)

On the 18th (US local time), international gold prices rose slightly. The decline in the U.S. dollar and government bond yields, as well as geopolitical risks in the Red Sea, drove up gold prices.

On Monday (local time) at the New York Mercantile Exchange, the gold price for February next year ended trading at $2,040.50 per ounce, up $4.8 (0.23%) from the previous day. Gold prices rebounded after two trading days. Intraday gold prices moved within the range of 2,029.50 to 2,048.00. As the dollar has shown overall weakness since the U.S. Federal Reserve's pivot was formalized last week, gold prices have maintained the psychological support level of $2,000 for the fourth trading day.

On this day, the dollar and government bond interest rates showed a downward trend, and gold prices rose. It was interpreted that the aftermath of the U.S. Federal Reserve's dovish stance last week encouraged the weakening of the dollar and government bond yields.

The dollar index, which reflects the dollar's value against six major currencies, recorded 102.452, down 0.15% from the previous day. The 10-year government bond interest rate recorded 3.913%, down from the previous trading day. The 2-year Treasury yield, which is sensitive to monetary policy, was trading at 4.425%, and the 30-year Treasury bond yield was trading at 4.025%, down 0.54bp.

The decline in dollar and government bond yields is a favorable factor for gold prices. This is because it lowers the perceived price of gold, which is usually traded in dollars, stimulating the purchasing sentiment of overseas buyers and lowering the opportunity cost of holding gold.

The geopolitical crisis in the Red Sea region also led to a buying trend of safe asset gold. Foreign media reported that day that Yemeni rebels Houthis had launched a series of attacks on civilian ships in the Red Sea with the intention of intervening in the war between Israel and Hamas. According to foreign media outlets such as AFP, Yemeni rebels Houthis, who are friendly with Iran, said in a statement, "Yemeni forces (rebels) used maritime drones to carry out military operations against two ships related to the Zionist (Israeli) authorities." As attacks by Yemen's pro-Iran rebels Houthi targeting civilian ships in the Red Sea, a major sea route connecting Asia and Europe, intensify, concerns are growing that oil prices will also be affected.

“Precious metals markets have taken a breather waiting for the next major economic indicator or news, but among gold traders there is technical strength and buying sentiment at the bottom,” said Jim Wyckoff, principal analyst at Kitco Metals. . He added, “The fundamental factors that are keeping the gold price going are the weakening U.S. dollar, the easy monetary policy of major central banks, especially the Federal Reserve, and the demand for safe assets due to heightened tensions in the Middle East.”

Investors are awaiting key economic data this week, including key personal consumption expenditures (PCE) data for November released on Friday.

On the 20th, the US Conference Board Consumer Confidence Index and the UK Consumer Price Index will be announced. On the 21st, the Philadelphia Fed's December manufacturing index will be released, and on the 22nd, the November index of personal consumption expenditure PCE, the price index that the Fed is most interested in, along with December's durable goods orders. Along with economic indicators, the ongoing war in the Middle East is also something to look at.

Meanwhile, the price of silver fell $0.047 (0.19%) to $24.154 per ounce. On the other hand, copper ended trading at $3.8520, down nearly 1% ($0.0385) from the previous day.

At this time, the international gold price (as of 9:50 a.m., London LBMA gold price) is moving around the $2,026 level.

Domestic gold prices, which had been falling and remaining flat since the middle of last week, rebounded after four trading days. Due to the influence of international gold prices and the rise in the won/dollar exchange rate, domestic gold prices rose slightly on the morning of the 19th.

According to the Korea Gold Exchange on this day, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 363,000 won (VAT included), a 0.55% increase from the previous price (as of 9:50 a.m.).

When a consumer sells 1 dong of pure gold, the price is 316,000 won, up 0.32% from the previous price. When selling 18k and 14k, the price was 232,300 won and 180,200 won, respectively, an increase of more than 0.3% compared to the previous trading day (product prices are applied when purchasing 18k and 14k).

In addition, the price when buying silver was 4,390 won, the same as the previous trading day, and when selling silver, it was 3,490 won. The price for buying platinum was 168,000 won and the price for selling it was 141,000 won, up 0.6% and 0.71% respectively from the previous day.

The Korea Exchange (KRX) and Shinhan Bank gold prices are also showing an upward trend, and the price per gram of 1 kg spot gold is trading at around 85,000 won.

As of 9:50 am, the Korea Exchange (KRX) gold price is 85,100 won per gram, up 0.37% from the previous day's closing price, and Shinhan Bank's gold price is 84,855.85 won per gram, up 0.18% (149.82 won).

In the Seoul foreign exchange market, the won-dollar exchange rate opened at 1,302.50 won, up 5.30 won from the previous trading day.

Detailed daily gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

New Media Department Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com