| 오늘 금시세(금값)↑↑ 주홍철 기자 jhc@kjdaily.com |

| 2024년 01월 13일(토) 15:10 |

|

-오늘의 금시세(한국금거래소 0.81%↑)

12일(미국 현지시간) 국제 금값이 급등했다. 중동의 군사 갈등 고조, 美 경제 지표 부진이 금가격을 끌어올렸다.

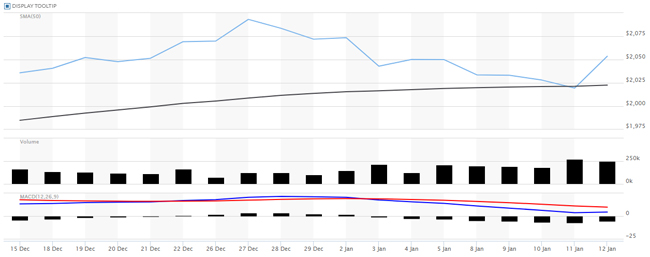

금요일(현지시간) 뉴욕상품거래소에서 올해 2월물 금값은 전일 대비 32.40달러(1.6%) 상승한 온스당 2,051.60달러에 거래를 마감했다. 이는 종가 기준 지난 2일 이후 10여 일만에 가장 높은 수준이다. 최근 美 연준의 조기 금리 인하 기대감 후퇴로 조정받던 금가격은 6거래일만에 상승했다.

이날 중동 지역의 군사적 갈등이 고조되면서 금은 안전 피난처로써의 지위를 누렸다. 금은 경제 및 지정학적 위기에 대한 헤지 수단으로 간주되기 때문이다.

미국과 영국은 이날 글로벌 물류의 동맥인 홍해를 위협해온 친이란 예멘반군 후티의 근거지에 폭격을 가했다.

이는 후티가 팔레스타인을 지지하며 작년말부터 홍해에서 벌여온 상선 공격에 대한 직접 보복이다. 팔레스타인 무장정파 하마스와 이스라엘의 가자지구 전쟁에 서방국가와 주변국까지 본격 개입하는 중동전쟁으로 확대될 우려가 커지고 있다. 중동의 상황이 확전으로 기울어지면서 가자지구 전쟁의 휴전 혹은 종료 가능성도 희박해졌다.

이 같은 중동의 갈등 고조 소식에 금값은 장중 2,067.30달러까지 치솟았다.

이날 발표된 12월 생산자물가지수(PPI)도 금시세 상승을 도왔다. 미국 12월 생산자물가지수(PPI)가 월가 예상치보다 더 둔화한 것으로 나타나면서 3월 기준금리 인하론이 다시 탄력을 받아서다.

귀금속 시장은 지난해 12월 PPI 결과에 주목했다.

미국 노동부는 12월 PPI가 계절 조정 기준으로 전월 대비 0.1% 하락했다고 이날 발표했다. 이는 월스트리트저널(WSJ)이 집계한 전문가 예상치 0.1% 상승을 밑도는 결과다.

작년 11월 PPI는 전월 대비 0.1% 하락으로 조정됐다. 기존 수치는 전월과 같은 수준이었다.

비계절 조정 기준 11월 PPI는 전년 동기 대비 1.0% 올랐다.

전날 발표된 CPI가 시장 예상보다 더 올랐던 상황에서 이날 예상치를 밑돈 PPI는 3월 금리 인하 가능성을 다시 높였다.

CME Fedwatch 도구에 따르면 트레이더들은 3월 금리 인하 확률을 80%로 보고 있다. 이는 PPI 보고서 이전의 약 70%보다 오른 수치다.

3월 기준금리 인하론이 다시 탄력을 받으면서 금과 역관계인 달러화 가치도 하락했다.

주요 6개 통화에 대한 달러 가치를 반영하는 달러 인덱스는 전장 대비 0.091 내린 102.435로 마감했다.

달러화 하락은 통상 달러로 거래되는 금의 체감가격을 낮춰 해외바이어들의 매수심리를 자극하는 금의 우호적인 요인이다.

TD 증권의 상품 전략 책임자인 바트 멜렉은 "지정학적 위험의 증가로 금시세가 상승하고 동시에 미국 중앙은행이 통화 제한 정책을 완화할 준비를 하고 있을 수도 있다"고 설명했다.

한 주간 금값은 0.1% 상승했다. 이로써 최근 조정 받았던 금가격이 2주 만에 주간 상승세로 돌아섰다.

|

한편, 은 가격도 급등했다. 국제 은 가격은 2.7% 상승한 온스당 23.329달러에 거래를 마감했다. 반면 구리는 약 1% 내린 3.7405달러를 나타냈다.

플래티넘은 0.5% 하락한 910.49달러를 기록하며 2주 연속 하락했다. 팔라듐은 1.3% 하락한 975.51달러로 3주 연속 하락했다.

이 시각 국제 금시세(오후 3시 기준, 런던 LBMA 금값시세)는 2,048달러 선에 움직이고 있다.

국제 금가격 상승에 따라 국내 금값도 13일 상승세를 나타냈다.

이날 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장보다 0.8%(3000원) 오른 370,000원(VAT포함)이다(오후 3시 기준). 이는 지난 3일 이후 열흘 만에 가장 높은 수준이다.

소비자가 순금 1돈 팔때 가격은 전장 대비 0.31% 오른 326,000원이다. 18k, 14k 팔때 가격도 각각 239,700원, 185,900원으로 전 거래일 대비 0.33% 올랐다.(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일 대비 1.85% 오른 4,330원, 팔때는 1.75% 오른 3,430원을 나타냈다. 백금 살때 가격은 전일보다 1.85% 내린 162,000원, 팔때 가격은 0.74% 하락한 136,000원이다.

전날 서울 외환시장에서 원·달러 환율은 전 거래일(1312.9원)보다 0.6원 오른 1313.5원에 마감했다.

자세한 일일 금값시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/주홍철 기자 jhc@kjdaily.com

-아래는 위 기사를 영어로 번역한 영문 전문이다. 기사 번역에 다소 오류가 있을 수 있다

-12th international gold price 1.6%↑

-Today’s gold price (Korea Gold Exchange 0.81%↑)

On the 12th (US local time), international gold prices soared. Escalating military conflict in the Middle East and sluggish U.S. economic indicators have driven up gold prices.

On Friday (local time) at the New York Mercantile Exchange, the gold price for February futures this year closed at $2,051.60 per ounce, up $32.40 (1.6%) from the previous day. This is the highest level in 10 days since the closing price on the 2nd. Gold prices, which had recently been adjusted due to expectations of an early interest rate cut by the U.S. Federal Reserve, rose for the first time in six trading days.

On this day, as military conflict in the Middle East escalated, gold enjoyed its status as a safe haven. This is because gold is considered a hedge against economic and geopolitical crises.

On this day, the United States and Britain bombed the base of the Houthis, a pro-Iran Yemeni rebel group that has been threatening the Red Sea, the artery of global logistics.

This is direct retaliation for attacks on commercial ships that the Houthis have been carrying out in the Red Sea since late last year in support of Palestine. There are growing concerns that the war between the Palestinian armed faction Hamas and Israel in the Gaza Strip will expand into a Middle East war in which Western countries and neighboring countries become fully involved. As the situation in the Middle East tilts towards escalation, the possibility of a ceasefire or end to the war in Gaza becomes slim.

With news of this escalating conflict in the Middle East, the price of gold soared to $2,067.30 during the day.

The December Producer Price Index (PPI) announced on this day also helped the gold price rise. As the U.S. producer price index (PPI) in December appeared to have slowed more than Wall Street expected, calls for a base interest rate cut in March gained momentum again.

The precious metals market paid attention to the PPI results in December last year.

The U.S. Department of Labor announced today that PPI in December fell 0.1% from the previous month on a seasonally adjusted basis. This result is lower than the 0.1% increase expected by experts compiled by the Wall Street Journal (WSJ).

Last November, PPI was adjusted to a 0.1% decline compared to the previous month. The existing figures were the same as the previous month.

On a non-seasonally adjusted basis, PPI in November rose 1.0% compared to the same period last year.

In a situation where the CPI announced the previous day rose more than market expectations, the PPI, which fell below expectations today, again raised the possibility of an interest rate cut in March.

According to the CME Fedwatch tool, traders see an 80% chance of a rate cut in March. This is an increase from about 70% before the PPI report.

As the policy of lowering the benchmark interest rate gained momentum again in March, the value of the dollar, which is inversely related to gold, also fell.

The dollar index, which reflects the dollar's value against six major currencies, closed at 102.435, down 0.091 from the previous day.

The decline in the dollar is a favorable factor for gold, stimulating the purchasing sentiment of overseas buyers by lowering the perceived price of gold, which is usually traded in dollars.

“Increasing geopolitical risks could push gold prices higher, while the U.S. central bank may be preparing to ease monetary restrictions,” said Bart Melek, head of product strategy at TD Securities.

Gold prices rose 0.1% during the week. As a result, the gold price, which had recently been adjusted, returned to a weekly upward trend for the first time in two weeks.

Meanwhile, silver prices also soared. International silver prices rose 2.7% to close at $23.329 per ounce. On the other hand, copper fell about 1% to $3.7405.

Platinum fell 0.5% to $910.49, falling for the second week in a row. Palladium fell 1.3% to $975.51, falling for the third straight week.

At this time, the international gold price (as of 3 p.m., London LBMA gold price) is moving around the $2,048 level.

With the rise in international gold prices, domestic gold prices also showed an upward trend on the 13th.

According to the Korea Gold Exchange on this day, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 370,000 won (VAT included), up 0.8% (3,000 won) from the previous price (as of 3 p.m.). This is the highest level in 10 days since the 3rd.

When a consumer sells 1 dong of pure gold, the price is 326,000 won, up 0.31% from the previous price. When selling 18k and 14k, the price was 239,700 won and 185,900 won, respectively, up 0.33% from the previous trading day. (When buying 18k and 14k, the product market price is applied).

In addition, the price when buying silver was 4,330 won, up 1.85% from the previous trading day, and when selling silver, it was 3,430 won, up 1.75% from the previous trading day. The price to buy platinum is 162,000 won, down 1.85% from the previous day, and the price to sell it is 136,000 won, down 0.74% from the previous day.

The previous day, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1,313.5 won, up 0.6 won from the previous trading day (1,312.9 won).

Detailed daily gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com