| 오늘 금시세(금값)↓ 주홍철 기자 jhc@kjdaily.com |

| 2024년 02월 10일(토) 15:00 |

|

-오늘의 금시세(한국금거래소 0.54%↓)

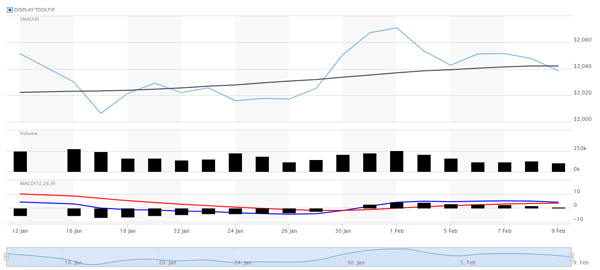

9일(미국 현지시간) 국제 금값이 美 국채 수익률 상승으로 인해 하락했다. 한 주간 금가격도 2주 만에 내림세로 돌아섰다.

금요일(현지시간) 뉴욕상품거래소에서 올해 4월물 금값은 전일 대비 9.20달러(0.44%) 하락한 온스당 2,038.70달러에 거래를 마감했다. 이는 지난달 29일 이후 가장 낮은 수준이다.

이날 금값 하락은 美 국채 수익률 상승에서 비롯됐다. 연방준비제도(Fed·연준) 관계자들이 연일 시장의 기대감과 거리 두는 금리인하 전망을 내놓으면서 국채 수익률이 상승한 것으로 풀이됐다. 국채 수익률 상승은 이자가 지급되지 않는 금을 보유하는 데 대한 기회비용을 높이는 금의 비우호적인 요인이다.

10년 만기 미국 국채 수익률은 2주 최고치로 올랐고, 2년물 수익률은 약 2개월 만에 최고치를 기록하며 금시세에 하방압력을 가했다.

연준 인사는 이날도 시장 기대치와 거리가 있는 금리인하 전망을 내놨다. 앞서 이번 주 공개 발언에 나선 연준 당국자들은 하나같이 금리인하를 서두를 필요가 없다고 입을 모으며 시장의 기대감을 누르고 있다.

라파엘 보스틱 미국 애틀랜타 연방준비은행(연은) 총재는 이날 연설에서 미국 경제의 튼튼한 체력 등을 고려하면 연준은 금리인하를 서두를 필요가 없다며 하반기에 2회 정도 인하를 예상하고 있다고 말했다.

로리 로건 댈러스 연은 총재도 이날 연설에서 연준은 다급하게 금리를 내릴 필요가 없다고 강조했다.

전날에는 수전 콜린스 보스턴 연은 총재가 12개월 인플레이션이 목표치에 도달할 때까지 인하를 늦추는 것은 "너무 오래 기다리는 것"이라면서도 올해 75bp가량의 금리 인하를 예상하기도 했다.

연준 인사들의 이같은 공개 발언에 시장의 기대감도 계속 꺾이면서 '3월 인하론'은 어느새 폐기되는 분위기다.

이 같은 연준의 잇단 매파적 발언에 이날 장중 금가격은 2,034.30달러까지 하락했다.

이로써 이번주 국제 금값은 종가기준 전주 대비 0.75% 내려앉았다. 연준의 금리 조기 인하 기대감 후퇴가 한 주간 금시세를 2주만에 하락세로 돌렸다.

전문가들은 연준이 더 오랫동안 금리를 높게 유지할 가능성이 높으며 이는 대부분의 중앙은행이 이를 따를 것이라고 내다봤다.

게인스빌 코인스의 수석 시장 분석가인 에버렛 밀먼은 "연준의 고금리 장기화로 금값이 낮아지는 추세라고 생각한다"며 "다만, 온스당 1,960달러에 매우 강력한 지지대가 있어 금가격이 그 아래로 떨어질 것으로 예상하지 않는다"고 말했다.

또, 그는 "제롬 파월 의장을 포함한 몇몇 연준 관리들은 금리를 인하하기 전에 인플레이션이 계속 하락할 것이라는 더 많은 증거를 보고 싶어 한다"고 덧붙였다.

귀금속 투자자들은 이날 발표된 소비자물가지수(CPI) 수정치에도 주목했다.

미 노동부는 지난해 12월 CPI를 전월 대비 0.2% 오른 것으로 수정했다. 당초에는 0.3% 올랐었다. 11월 수치는 전월 대비 0.1% 상승에서 0.2% 상승으로 수정했다. 이번 수정은 계절 조정인 전월 대비 수치를 연초에 수정하는 작업에 따른 것이다.

미국의 CPI는 전월 대비로 지난해 8월 0.5% 상승을 기록한 이후 9월 0.4%, 10월 0.1%, 11월 0.2%, 12월 0.2%로 추세적으로 둔화하는 모습을 보였다.

12월 근원 CPI 수치는 전월 대비 0.3% 올라 기존 발표치와 같았다.

인플레이션이 계속 둔화할 경우 연방준비제도(연준·Fed)는 기준금리를 인하할 것으로 예상된다. 관건은 인하 시점과 속도다.

시장에서는 연준이 올해 5월에는 금리 인하에 나설 것으로 예상하고 있지만, 인플레이션이 예상만큼 빠르게 내려오지 않을 경우 연준의 관망세는 길어질 것으로 보인다. 연준의 고금리 장기화는 금가격 상승을 제한하는 부정적인 요인이다. CME Fedwatch 도구에 따르면 시장은 현재 5월 금리 인하 가능성이 약 61%로 보고 있다.

이제 귀금속 시장은 오는 13일 발표되는 미국 1월 소비자물가지수(CPI) 발표에 초점을 맞추고 있다.

|

한편, 은 가격은 0.18% 하락한 온스당 22.594달러에 거래를 마쳤고, 구리는 0.55% 하락한 3.6815달러를 기록했다. 팔라듐은 2.5% 하락한 온스당 865.07달러, 백금은 1.6% 하락한 870.97달러에 거래됐다. 두 금속 가격은 두 번째 주간 하락세를 보이고 있다.

이 시각 국제 금시세(오후 3시 기준, 런던 LBMA 금값시세)는 2,024달러 선에 움직이고 있다.

국내 금값도 10일 오전 하락세를 나타냈다.

이날 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.54%(2000원) 내린 370,000원(VAT포함)이다(오후 3시 기준).

소비자가 순금 1돈 팔때 가격은 전장과 같은 331,000원이다. 18k, 14k 팔때 가격도 각각 243,300원, 188,700원으로 전 거래일과 같은 수준이다.(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일과 같은 4,270원, 팔때는 0.29% 오른 3,400원을 기록했다. 백금 살때 가격은 전일보다 1.89% 하락한 159,000원, 팔때 가격은 1.5% 내린 133,000원이다.

지난 8일 서울 외환시장에서 원·달러 환율은 전 거래일보다 0.4원 오른 1328.2원 마감했다.

자세한 일일 금값시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/뉴미디어부 주홍철 기자 jhc@kjdaily.com

-아래는 위 기사를 영어로 번역한 전문이다. 기사 번역에 다소 오류가 있을 수 있다

-9th international gold price 0.44%↓

-Today’s gold price (Korea Gold Exchange 0.54%↓)

On the 9th (US local time), international gold prices fell due to the rise in US Treasury yields. The price of gold also turned downward for the first time in two weeks.

On Friday (local time) at the New York Mercantile Exchange, this year's April gold price closed at $2,038.70 per ounce, down $9.20 (0.44%) from the previous day. This is the lowest level since the 29th of last month.

The decline in gold prices on this day was caused by a rise in U.S. Treasury yields. It was interpreted that government bond yields rose as Federal Reserve officials each day presented interest rate cut forecasts that distanced themselves from market expectations. Rising government bond yields are an unfavorable factor for gold, raising the opportunity cost of holding gold that does not pay interest.

The 10-year U.S. Treasury yield rose to a two-week high, and the 2-year yield hit its highest in about two months, putting downward pressure on the gold price.

On this day, Federal Reserve personnel also presented a forecast for an interest rate cut that was far from market expectations. Federal Reserve officials who made public remarks this week are suppressing market expectations by unanimously saying there is no need to rush to cut interest rates.

Raphael Bostic, President of the Atlanta Federal Reserve Bank, said in a speech that day, “Considering the strong health of the U.S. economy, there is no need for the Federal Reserve to rush to cut interest rates,” and said that he expects about two cuts in the second half of the year.

In his speech that day, Dallas Fed President Rory Logan also emphasized that there was no need for the Fed to lower interest rates urgently.

The previous day, Boston Federal Reserve President Susan Collins predicted an interest rate cut of about 75 basis points this year, saying that delaying the cut until 12-month inflation reaches the target would be "waiting too long."

As the market's expectations continue to be dampened by such public remarks by Federal Reserve officials, the 'March cut theory' seems to have been discarded before we know it.

Due to the Federal Reserve's series of hawkish remarks, the intraday gold price fell to $2,034.30.

As a result, the international gold price this week fell 0.75% compared to the previous week as of the closing price. The decline in expectations of an early interest rate cut by the Federal Reserve sent gold prices into a downward trend for the first time in two weeks.

Experts predict that the Federal Reserve is likely to keep interest rates high for longer, and that most central banks will follow suit.

Everett Millman, senior market analyst at Gainesville Coins, said, “I think the price of gold is trending lower due to the Federal Reserve’s prolonged high interest rates,” adding, “However, there is a very strong support level at $1,960 per ounce, so I don’t expect the price to fall below that.” “I don’t,” he said.

He added that some Fed officials, including Chairman Jerome Powell, want to see more evidence that inflation will continue to fall before cutting interest rates.

Precious metals investors also paid attention to the revised Consumer Price Index (CPI) announced today.

The U.S. Department of Labor revised the CPI in December last year to an increase of 0.2% compared to the previous month. It initially rose by 0.3%. The November figure was revised from a 0.1% increase compared to the previous month to a 0.2% increase. This revision is in accordance with the work of revising the seasonal adjustment, compared to the previous month, at the beginning of the year.

After recording a 0.5% increase in August of last year compared to the previous month, the U.S. CPI showed a trend of slowing to 0.4% in September, 0.1% in October, 0.2% in November, and 0.2% in December.

The core CPI figure in December rose 0.3% compared to the previous month, the same as the previously announced value.

If inflation continues to slow, the Federal Reserve System (Fed) is expected to lower the base interest rate. The key is the timing and speed of the reduction.

The market expects the Federal Reserve to cut interest rates in May of this year, but if inflation does not come down as quickly as expected, the Federal Reserve's wait-and-see stance is expected to extend. The Federal Reserve's prolonged high interest rates are a negative factor limiting the rise in gold prices. According to the CME Fedwatch tool, the market currently sees a 61% chance of a rate cut in May.

The precious metals market is now focused on the US January Consumer Price Index (CPI) to be announced on the 13th.

Meanwhile, silver prices fell 0.18% to $22.594 per ounce, and copper fell 0.55% to $3.6815. Palladium was trading at $865.07 per ounce, down 2.5%, and platinum was trading at $870.97, down 1.6%. The prices of both metals are showing their second weekly decline.

At this time, the international gold price (as of 3 p.m., London LBMA gold price) is moving around the $2,024 level.

Domestic gold prices also showed a downward trend on the morning of the 10th.

According to the Korea Gold Exchange on this day, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 370,000 won (VAT included), down 0.54% (2,000 won) from the previous price (as of 3 p.m.).

When a consumer sells 1 dong of pure gold, the price is 331,000 won, the same as the battlefield. When selling 18k and 14k, the prices are 243,300 won and 188,700 won, respectively, which are the same as the previous trading day. (When buying 18k and 14k, the product market price is applied).

In addition, the price when buying silver was 4,270 won, the same as the previous trading day, and when selling silver, it was 3,400 won, up 0.29%. The price to buy platinum is 159,000 won, down 1.89% from the previous day, and the price to sell it is 133,000 won, down 1.5% from the previous day.

On the 8th, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1328.2 won, up 0.4 won from the previous trading day.

Detailed daily gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/New Media Department Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com