| 금시세(금값)…한 달만에 최저치 주홍철 기자 jhc@kjdaily.com |

| 2024년 05월 04일(토) 09:45 |

|

-오늘의 금시세(한국금거래소 0.7%↓)

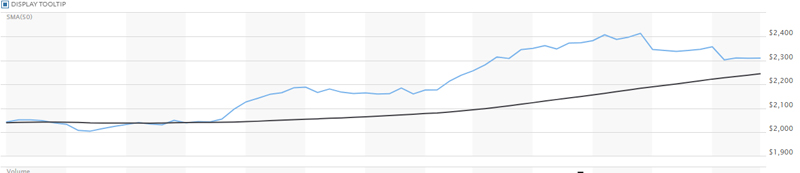

국제 금값이 약보합세를 나타냈다. 또, 국내 금가격은 한 달만에 최저치로 내려앉았다.

금요일(3일 현지시간) 뉴욕상품거래소에서 올해 6월물 금값은 전일 대비 0.04%(1달러) 하락한 온스당 2,308.60달러에 거래를 마감했다. 최근 금가격은 조정국면을 거치며, 2300달러 선에서 안정화되는 모습이다.

이날 귀금속 시장은 4월 미국의 비농업 일자리 데이타에 주목했다.

3일(현지시간) 미 노동부에 따르면 4월 미국의 비농업 일자리는 전월 대비 17만5천건 늘었다.

이는 다우존스가 집계한 전문가 전망치 24만명을 큰 폭으로 밑도는 수치다.

또한 직전 12개월간 평균 증가분(24만2천건)에도 크게 못 미쳤다.

4월 실업률은 3.9%로, 3월의 3.8%에서 증가하며 전문가 전망치(3.8%)를 웃돌았다.

시간당 평균임금 상승률은 전월 대비 0.2%로 시장 전망(0.3%)에 못 미쳤다. 1년 전과 비교한 평균임금 상승률은 3.9%로 2021년 6월 이후 2년 10개월 만에 가장 낮았다.

평균 수준을 크게 밑도는 고용 증가세와 임금 상승률은 둔화는 미 노동시장이 식어가고 있음을 시사한다. 고용시장 둔화는 美 연준의 고금리 장기화 우려를 낮추는 금의 긍정적인 요인이다.

고용 초과수요에 기반한 뜨거운 고용시장은 그동안 미국의 물가상승 압력을 높이는 주된 요인으로 지목돼왔다.

미국의 4월 신규 일자리 증가 폭은 예상치를 크게 밑돈 것으로 나타나면서 장중 금가격은 한때 2,330.70달러까지 상승했다.

하지만, 차익 실현 매물이 출회되면서 장중 금시세는 다시 2300달러 초반대로 내려앉았다. 연준이 금리 인하를 서두르지 않을 것이라는 예상이 시장에 깔리면서 투자자들은 이익을 현금화하는 것을 선택했다.

|

한 주간 국제 금값은 지난주 대비 1.64%(38.6%) 하락하면서 2주 연속 하락세를 기록했다. 미국 금리가 장기간 높은 수준을 유지할 것이라는 전망과 안전 피난처 수요 하락이 금가격을 끌어내렸다.

은 가격은 0.5% 하락한 26.690달러에 거래를 마감했고, 구리는 1.6% 상승한 4.5570달러를 나타냈다.

산업용 금속 중에서 구리 가격은 금요일 보합세를 보였으며, 미국 금리에 대한 우려로 일부 차익실현이 촉발되면서 주간 하락세를 나타냈다. 그러나 가격은 여전히 최근 2년 최고치를 기록하고 있다.

런던 금속 거래소의 3개월 구리 선물은 0.2% 상승한 톤당 9,827.0달러를 나타냈고, 1개월 구리 선물은 소폭 하락한 파운드당 4.5012달러를 기록했다.

이 시각 국제 금값시세(오전 9시 40분 기준, 런던 LBMA 금값시세)는 2,302달러 선에 움직이고 있다.

국내 금가격도 하락세를 나타냈다.

4일 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.7%(3000원) 하락한 426,000원(VAT포함)이다(오전 9시 40분 기준). 이는 지난달 5일 이후 한 달만에 가장 낮은 수준이다.

소비자가 순금 1돈 팔때 가격은 전장보다 1.09% 내린 368,000원이다. 18k, 14k 팔때 가격도 각각 270,500원, 209,800원으로 전 거래일 대비 1.1% 하락했다(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일 대비 1.17% 내린 5,110원, 팔때는 1.23% 하락한 상승한 4,060원을 기록했다. 백금 살때 가격은 전일보다 1.1% 하락한 182,000원, 팔때 가격은 0.68% 내린 148,000원이다.

전날 서울 외환시장에서 원·달러 환율은 전거래일보다 13.1원 내린 1362.8원에 마감했다.

자세한 국내 금시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/주홍철 기자 jhc@kjdaily.com

-다음은 위 기사를 영어로 번역한 전문이다. 번역에 오류가 있을 수 있다.

-3-day international gold price 0.04%↓

-Today’s gold price (Korea Gold Exchange 0.7%↓)

International gold prices showed a weak trend. Additionally, the domestic gold price fell to its lowest level in a month.

On Friday (the 3rd local time) at the New York Mercantile Exchange, the gold price for June futures this year closed at $2,308.60 per ounce, down 0.04% ($1) from the previous day. Recently, the price of gold has gone through an adjustment phase and appears to be stabilizing at the $2,300 level.

On this day, the precious metals market paid attention to the US non-farm employment data for April.

According to the U.S. Department of Labor on the 3rd (local time), non-agricultural jobs in the U.S. increased by 175,000 in April compared to the previous month.

This figure is significantly lower than the 240,000 expected by Dow Jones.

In addition, it was significantly less than the average increase over the previous 12 months (242,000 cases).

The unemployment rate in April was 3.9%, increasing from 3.8% in March and exceeding experts' forecasts (3.8%).

The average hourly wage increase rate was 0.2% compared to the previous month, which was lower than the market forecast (0.3%). The average wage increase rate compared to a year ago was 3.9%, the lowest in 2 years and 10 months since June 2021.

Employment growth that is well below average and slowing wage growth suggest that the U.S. labor market is cooling down. The slowing job market is a positive factor for gold, lowering concerns about the prolonged high interest rates from the U.S. Federal Reserve.

The hot employment market based on excess demand for employment has been pointed out as a major factor in increasing inflationary pressure in the United States.

The intraday gold price rose to $2,330.70 at one point as the increase in new jobs in the United States in April was significantly below expectations.

However, as profit-taking items were sold, the intraday gold price fell back to the low $2,300 range. As the market assumed that the Federal Reserve would not rush to cut interest rates, investors chose to cash out their profits.

During the week, the international gold price fell 1.64% (38.6%) compared to the previous week, recording a downward trend for two consecutive weeks. The prospect that U.S. interest rates will remain high for an extended period of time and the decline in safe haven demand have pulled down gold prices.

Silver prices closed at $26.690, down 0.5%, while copper rose 1.6% to $4.5570.

Among industrial metals, copper prices were flat on Friday and fell for the week as concerns about U.S. interest rates prompted some profit-taking. However, prices are still at two-year highs.

Three-month copper futures on the London Metal Exchange rose 0.2% to $9,827.0 per tonne, while one-month copper futures fell slightly to $4.5012 per pound.

At this time, the international gold price (as of 9:40 a.m., London LBMA gold price) is moving around the $2,302 level.

Domestic gold prices also showed a downward trend.

According to the Korea Gold Exchange on the 4th, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 426,000 won (VAT included), down 0.7% (3,000 won) from the previous price (as of 9:40 a.m.). This is the lowest level in a month since the 5th of last month.

When a consumer sells 1 dong of pure gold, the price is 368,000 won, down 1.09% from the previous price. The price when selling 18k and 14k was 270,500 won and 209,800 won, respectively, down 1.1% from the previous trading day (the product market price is applied when buying 18k and 14k).

In addition, the price when buying silver was 5,110 won, down 1.17% from the previous trading day, and when selling silver, it was 4,060 won, down 1.23% from the previous trading day. The price to buy platinum is 182,000 won, down 1.1% from the previous day, and the price to sell it is 148,000 won, down 0.68% from the previous day.

The day before in the Seoul foreign exchange market, the won-dollar exchange rate closed at 1362.8 won, down 13.1 won from the previous trading day.

Detailed domestic gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com