| 금시세(금값)…주간 2.9%↑ 주홍철 기자 jhc@kjdaily.com |

| 2024년 05월 11일(토) 07:31 |

|

-오늘의 금시세(한국금거래소 0.23%↑)

국제 금값이 급등하면서 주간 상승세를 기록했다. 美 연준의 금리 인하 기대감이 금가격을 끌어올렸다. 국내 금값도 3주 만에 1돈당 44만원 선을 돌파했다.

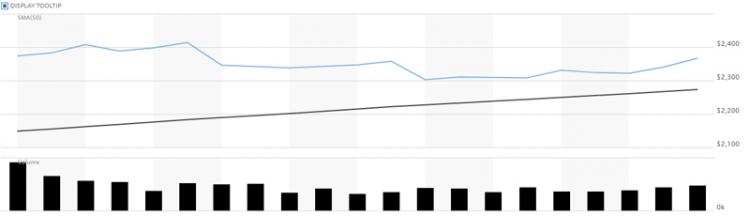

금요일(10일 현지시간) 뉴욕상품거래소에서 올해 6월물 금값은 전일 대비 1.5%(34.7달러) 급등한 온스당 2,375.0달러에 거래를 마감했다. 이는 지난달 19일 이후 3주 만에 가장 높은 수준이다. 일일 가격 상승폭도 지난달 5일 이후 한 달만에 가장 큰 수준이다. 종가 기준 한 주간 금가격은 2.9% 상승하며, 지난달 19일 이후 3주 만에 오름세로 돌아섰다.

이날 금값 상승은 전날 발표된 주간 실업보험 청구자수 지표의 여파에서 비롯됐다. 둔화된 고용지수 데이타가 연준의 금리 인하 기대감을 강화시켰기 때문이다.

주간 실업보험 청구자수는 지난해 8월 이후 가장 많은 수치를 기록했다.

미국 노동부에 따르면 지난 4일로 끝난 한 주간 신규 실업보험 청구자수는 계절조정 기준으로 23만1천명으로, 직전주보다 2만2천명 증가했다.

실업보험 청구자수는 최근까지 몇 달 동안 20만~21만명대로 유지되면서 타이트한 고용시장을 반영해왔다.

|

지난주에 실업보험 청구자수 증가세를 보인 점은 향후 고용시장이 완화될 것이라는 기대를 부추겼다.

이는 미 연준의 금리인하를 뒷받침할 신호를 찾고 있는 귀금속 시장에 호재로 작용했다.

CME FedWatch Tool에 따르면 트레이더들은 현재 연준이 7월까지 25베이시스 포인트(bp) 금리를 인하할 확률을 거의 25%로 예상하고 있으며, 9월에는 거의 49%까지 상승할 것으로 예상하고 있다.

중앙은행의 금리 인하는 이자가 붙지 않는 금을 보유하는 데 대한 기회비용을 낮추는 금의 긍정적인 요인이다.

기준 금리 인하 가능성이 높아지면서 이날 2,353.50달러에 개장한 금시세는 장중 한때 온스당 2,385.30달러까지 치솟으며 2400달러 선에 바싹 근접했다.

금 가격은 지난 4월 19일 종가 사상 최고치인 2,413.80달러에 안착한 이후 하락했지만, 금값은 올해 현재까지 여전히 14.6% 높은 수준으로 거래되고 있다.

귀금속 투자자들은 다음 주에 나올 4월 소비자물가지수(CPI), 생산자물가지수(PPI)를 기다리고 있다. 두개의 지표 모두 모두 금과 은 가격에 큰 영향을 미칠 수 있다.

Kitco의 수석 시장 분석가인 짐 와이코프(Jim Wyckoff)는 "다음 주에 뜨거운 인플레이션이나 심지어 따뜻한 인플레이션 데이터가 나오면 연준이 이르면 9월에 금리를 인하할 수 있다는 생각에 찬물을 끼얹게 될 것"이라고 설명했다.

한편, 은 가격은 0.5% 상승한 28.506달러에 거래를 마감했고, 구리는 1.7% 오른 4.6625달러를 나타냈다. 백금 현물은 1.9% 상승한 온스당 997.40달러, 팔라듐 현물은 1.1% 상승한 온스당 977.75달러를 기록했다.

이 시각 국제 금값시세(오전 9시 기준, 런던 LBMA 금값시세)는 2,360달러 선에 움직이고 있다.

국제 금값 상승에 따라 국내 금가격도 3거래일 연속 오름세를 나타내고 있다.

11일 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.23%(1000원) 상승한 441,000원(VAT포함)이다(오전 9시 기준). 국내 금값이 1돈당 44만원 선을 돌파한 것은 지난달 22일 이후 3주 만이다.

소비자가 순금 1돈 팔때 가격은 전장보다 0.26% 오른 383,000원이다. 18k, 14k 팔때 가격도 각각 281,600원, 218,400원으로 전 거래일보다 0.28% 상승했다(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일 대비 0.73% 내린 5,480원, 팔때는 0.92% 하락한 4,350원을 기록했다. 백금 살때 가격은 전일보다 1.04% 오른 192,000원, 팔때 가격은 1.29% 상승한 155,000원이다.

전날 서울 외환시장에서 원·달러 환율은 전 거래일보다 2.0원 내린 1,368.1원으로 장을 마쳤다.

자세한 국내 금시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

다음 주에 주목해야 할 경제 데이터:

화요일: 미국 PPI, 제롬 파월 연방준비은행 의장, 네덜란드 암스테르담에서 연설

수요일: 미국 CPI, 미국 소매판매, 뉴욕 연준 엠파이어 스테이트 설문조사

목요일: 미국 주간 실업 수당 청구, 미국 건축 허가 주택 착공, 필라델피아 연방준비은행 제조업 조사

/주홍철 기자 jhc@kjdaily.com

-다음은 위 기사를 영어로 번역한 전문이다. 번역에 오류가 있을 수 있다.

-10th international gold price 1.5%↑

-Today’s gold price (Korea Gold Exchange 0.23%↑)

International gold prices soared, recording a weekly rise. Expectations of an interest rate cut by the U.S. Federal Reserve drove up gold prices. Domestic gold prices also exceeded the 440,000 won per dollar mark in three weeks.

On Friday (10th local time) at the New York Mercantile Exchange, the gold price for June futures this year closed at $2,375.0 per ounce, up 1.5% ($34.7) from the previous day. This is the highest level in three weeks since the 19th of last month. The daily price increase is also the largest in a month since the 5th of last month. As of the closing price, the price of gold rose 2.9% in the week, turning to an upward trend for the first time in three weeks since the 19th of last month.

The rise in gold prices on this day came from the aftermath of the weekly unemployment insurance claimant index announced the previous day. This is because the slowing employment index data strengthened expectations of an interest rate cut by the Federal Reserve.

The number of weekly unemployment insurance claims was the highest since August of last year.

According to the U.S. Department of Labor, the number of new unemployment insurance claims for the week ending on the 4th was 231,000 on a seasonally adjusted basis, an increase of 22,000 from the previous week.

The number of unemployment insurance claimants has remained in the 200,000-210,000 range for several months, reflecting the tight job market.

The increase in unemployment insurance claims last week has fueled expectations that the job market will ease in the future.

This served as good news for the precious metals market, which is looking for signals to support the U.S. Federal Reserve's interest rate cut.

According to the CME FedWatch Tool, traders currently expect the Fed to cut interest rates by 25 basis points by July at a nearly 25% chance, with odds rising to nearly 49% by September.

The central bank's interest rate cut is a positive factor for gold, lowering the opportunity cost of holding gold that does not bear interest.

As the possibility of a base interest rate cut increased, the gold price, which opened at $2,353.50 on this day, soared to $2,385.30 per ounce at one point during the day, coming close to the $2,400 level.

Gold prices have fallen since settling at an all-time closing high of $2,413.80 on April 19, but the price is still trading 14.6% higher so far this year.

Precious metals investors are waiting for the April Consumer Price Index (CPI) and Producer Price Index (PPI) to be released next week. Both indicators can have a significant impact on gold and silver prices.

“Hot or even warm inflation data next week will pour cold water on the idea that the Fed could cut interest rates as early as September,” said Jim Wyckoff, senior market analyst at Kitco. did.

Meanwhile, silver prices closed at $28.506, up 0.5%, and copper rose 1.7% to $4.6625. Platinum spot rose 1.9% to $997.40 per ounce, and palladium spot rose 1.1% to $977.75 per ounce.

At this time, the international gold price (as of 9 a.m., London LBMA gold price) is moving around the $2,360 level.

As the international gold price rises, the domestic gold price is also showing an upward trend for three consecutive trading days.

According to the Korea Gold Exchange on the 11th, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 441,000 won (VAT included), up 0.23% (1,000 won) from the previous price (as of 9 a.m.). It has been three weeks since the 22nd of last month that the domestic gold price exceeded 440,000 won per dollar.

When a consumer sells 1 dong of pure gold, the price is 383,000 won, a 0.26% increase from the previous price. When selling 18k and 14k, the price was 281,600 won and 218,400 won, respectively, up 0.28% from the previous trading day (when buying 18k and 14k, the product market price is applied).

In addition, the price when buying silver was 5,480 won, down 0.73% from the previous trading day, and when selling silver, it was 4,350 won, down 0.92%. The price to buy platinum is 192,000 won, up 1.04% from the previous day, and the price to sell it is 155,000 won, up 1.29% from the previous day.

The previous day in the Seoul foreign exchange market, the won-dollar exchange rate closed at 1,368.1 won, down 2.0 won from the previous trading day.

Detailed domestic gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

Economic data to watch next week:

Tuesday: U.S. PPI, Federal Reserve Chairman Jerome Powell speaks in Amsterdam, Netherlands

Wednesday: US CPI, US Retail Sales, New York Fed Empire State Survey

Thursday: U.S. weekly unemployment claims, U.S. building permits housing starts, Federal Reserve Bank of Philadelphia manufacturing survey.

/Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com