|

-오늘의 금시세(한국거래소-KRX 0.29%↑)

-7월 한 달간 금가격 5.7% 상승

-"금값 온스당 2700달러까지 오를 수 있다"

국제 금값이 역대 종가 최고치를 기록했다. 지정학적 리스크와 美 연준의 금리 인하 기대감이 금가격을 끌어올렸다.

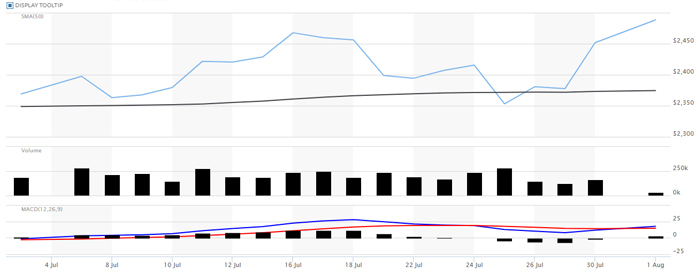

수요일(31일 현지시간) 뉴욕상업거래소에서 금 선물 가격은 전거래일 대비 0.86% 오른 온스당 2,473.0달러에 거래를 마감했다. 이는 종가 기준 1974년 계약 체결 이후 최고 수준이다. 직전 종가 최고치는 지난달 16일 기록한 2,467.80달러로 보름 만에 경신한 셈이다. 금가격은 이틀 연속 급등세를 나타내 지난달 17일 기록한 장중 사상 최고치인 2,488.40달러에도 바싹 근접한 모습이다.

제롬 파월 연방준비제도(Fed·연준) 의장이 9월 금리인하 개시 가능성을 강하게 시사하면서 매수세가 몰린 것으로 풀이됐다. 중앙은행의 금리 인하는 이자가 붙지 않는 금 보유에 따른 기회비용을 줄이는 금의 긍정적인 요인이다.

이날 FOMC 정례회의에서 기준금리는 5.25~5.50%로 동결됐다. 8회 연속 동결이다.

하지만 시장은 회의 후 파월 의장의 회견에 더 주목했다. 금리 동결은 예상된 바였고 파월 의장을 비롯한 FOMC 위원들이 금리인하에 어떤 입장인지가 더 중요했기 때문이다.

파월 의장은 "고용시장이 현재 수준으로 유지되면서 인플레이션이 하락한다면 9월에 기준금리 인하가 가능할 것"이라며 "9월에 금리인하가 (논의) 테이블에 오를 수 있다"고 밝혀 시장의 기대에 부응했다.

이를 비롯한 파월 의장의 발언은 전반적으로 강력한 비둘기파적이었다. 9월 금리인하를 강력하게 시사한 만큼 귀금속 투자자들은 매수 확대로 대응했다.

미국 경제매체 CNBC는 "파월 의장은 시장이 듣고 싶어 하는 것을 정확하게 말해줬다"고 평가했다.

시카고상품거래소(CME) 페드워치툴에 따르면 연방기금금리 선물시장은 이날 마감 무렵 9월 금리 인하 확률을 100%로 반영했다. 12월 말까지 기준금리가 25bp씩 3회 인하할 확률도 63% 수준으로 뛰어올랐다. 특히 12월까지 기준금리가 100bp 하락할 확률도 11.2%로 상승한 게 눈에 띈다.

이날 나온 미국 민간 고용 지표도 둔화 신호를 보내면서 금 매수 심리를 자극했다.

미국의 지난달 민간 고용 증가세는 월가의 예상치를 하회하며 둔화했다.

ADP 전미 고용보고서에 따르면 7월 민간 부문 고용은 전달보다 12만2천명 증가한 것으로 집계됐다. 이는 시장 예상치 14만7천명을 하회하는 수치다.

ADP 민간 고용 증가세는 지난 1월 이후 가장 둔화한 수준의 상승률을 보였다.

중동 지역의 지정학적 갈등도 금시세 상승에 일조했다. 금은 경제 및 지정학적 위기에 대한 헤지 수단으로 간주된다.

팔레스타인 무장정파 하마스의 정치국 최고 지도자 이스마일 하니예가 이란 수도 테헤란에서 이스라엘의 공격으로 암살됐다고 하마스가 이날 밝혔다.

이스라엘과 하마스 간 가자지구 전쟁이 약 10개월째 이어지는 와중에 하마스 서열 1위 지도자가 이란 심장부에서 살해되면서 중동 정세가 크게 요동칠 전망이다.

7월 한 달간 금가격은 무려 5.7% 상승했다. 전문가들은 금시세가 더 오를 것으로 전망하고 있다.

RJO Futures의 수석 시장 전략가인 밥 하버콘은 "연방준비제도이사회(Fed)가 금리를 인하하고 중동의 지정학적 위험이 더해지면 금값이 온스당 2,700달러까지 오를 가능성이 있다"고 말했다.

|

한편, 현물 은 가격은 온스당 28.85달러로 1.6% 상승했다. 플래티넘은 2.1% 올라 979.05달러를 나타냈고, 팔라듐은 4.6% 상승해 928.50달러를 기록했다. 세 가지 금속 모두 월별 하락세를 보였다.

이 시각 국제 금값시세(오후 1시 40분 기준, 런던 LBMA 금값시세)는 2,445달러 선에 움직이고 있다.

국제 금값 상승에 따라 국내 금가격도 이틀 연속 오름세를 나타냈다. 다만 미 달러화 약세에 따른 원/달러 환율 하락이 금가격 상승폭을 제한했다.

한국거래소(KRX) 금값은 전일 종가 대비 0.24% 상승한 g당 107,640원을 나타내고 있다(오후 1시 40분 기준).

신한은행 금시세는 0.13%(143.39원) 오른 107,164.87원을 기록했다.

한국금거래소에선 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장과 같은 453,000원(VAT포함)이다(오후 1시 40분 기준).

소비자가 순금 1돈 팔때 가격은 전장과 같은 397,000원이다. 18k, 14k 팔때 가격도 각각 291,800원, 226,300원으로 전 거래일과 같은 수준이다(18k와 14k 살때는 제품시세를 적용한다).

서울 외환시장에서 원·달러 환율은 전 거래일보다 8.5원 내린 1368.0원 거래를 출발했다.

자세한 국내 금시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/주홍철 기자 jhc@kjdaily.com

-다음은 위 기사를 영어로 번역한 전문이다. 번역에 오류가 있을 수 있다.

-31st International Gold Price ↑0.86%

-Today's Gold Price (Korea Exchange-KRX ↑0.29%)

-Gold Price Up 5.7% in July

-"Gold Price Could Rise to $2,700 per Ounce"

International gold prices hit an all-time high. Geopolitical risks and expectations of a U.S. Federal Reserve interest rate cut pushed up gold prices.

On Wednesday (31st local time), gold futures prices on the New York Mercantile Exchange closed at $2,473.0 per ounce, up 0.86% from the previous trading day. This is the highest closing price since the contract was signed in 1974. The previous closing price was $2,467.80, which was recorded on the 16th of last month, and it was renewed after 15 days. The price of gold has been on a sharp rise for two consecutive days, coming close to the intraday high of $2,488.40 recorded on the 17th of last month.

It was interpreted that the buying trend was driven by Federal Reserve Chairman Jerome Powell’s strong suggestion of a possible September rate cut. The central bank’s rate cut is a positive factor for gold, as it reduces the opportunity cost of holding gold that does not bear interest.

At the FOMC’s regular meeting that day, the benchmark interest rate was frozen at 5.25-5.50%. This is the 8th consecutive freeze.

However, the market paid more attention to Chairman Powell’s press conference after the meeting. The rate freeze was expected, and the stance of the FOMC members, including Chairman Powell, on the rate cut was more important.

Chairman Powell responded to market expectations by saying, “If the employment market remains at the current level and inflation declines, a rate cut could be possible in September,” and “A rate cut could be on the table (for discussion) in September.”

Powell's remarks, including this one, were generally strongly dovish. As he strongly suggested a September rate cut, precious metal investors responded by expanding their purchases.

CNBC, an American economic media outlet, evaluated that "Chairman Powell said exactly what the market wanted to hear."

According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the federal funds futures market reflected a 100% probability of a September rate cut at the end of the day. The probability of the base rate being cut three times by 25bp each by the end of December also jumped to 63%. In particular, the probability of the base rate falling 100bp by December also rose to 11.2%.

The US private employment index released that day also sent a signal of slowdown, stimulating gold buying sentiment.

The increase in private employment in the US last month slowed down, falling short of Wall Street's expectations.

According to the ADP National Employment Report, private sector employment in July increased by 122,000 from the previous month. This figure is lower than the market expectation of 147,000.

The ADP private employment growth rate showed the slowest growth rate since January.

Geopolitical conflicts in the Middle East also contributed to the rise in gold prices. Gold is considered a hedge against economic and geopolitical crises.

Hamas announced today that Ismail Haniyeh, the top leader of the political bureau of the Palestinian militant group Hamas, was assassinated in an Israeli attack in the Iranian capital Tehran.

The Middle East is expected to be greatly shaken by the assassination of Hamas’ top leader in the heart of Iran amid the ongoing Gaza Strip war between Israel and Hamas that has lasted for about 10 months.

Gold prices rose a whopping 5.7% in July. Experts predict that gold prices will rise further.

Bob Haberkorn, chief market strategist at RJO Futures, said, “If the Fed cuts rates and geopolitical risks in the Middle East increase, gold prices could rise to $2,700 per ounce.”

Meanwhile, spot silver prices rose 1.6% to $28.85 per ounce. Platinum rose 2.1% to $979.05, and palladium rose 4.6% to $928.50. All three metals showed monthly declines.

At this time, the international gold price (as of 1:40 p.m., London LBMA gold price) is moving around $2,445.

Domestic gold prices also rose for two consecutive days as the international gold price rose. However, the decline in the won/dollar exchange rate due to the weaker US dollar limited the increase in gold prices.

The Korea Exchange (KRX) gold price is 107,640 won per gram, up 0.24% from the previous day's closing price (as of 1:40 p.m.).

Shinhan Bank's gold price is 107,164.87 won, up 0.13% (143.39 won).

At the Korea Gold Exchange, when consumers buy 1 don (24k, 3.75g) of pure gold, the price is 453,000 won (including VAT), the same as the previous day (as of 1:40 p.m.).

When consumers sell 1 don of pure gold, the price is 397,000 won, the same as the previous day. The prices for selling 18k and 14k are 291,800 won and 226,300 won, respectively, the same as the previous trading day (when buying 18k and 14k, the product price is applied).

In the Seoul foreign exchange market, the won-dollar exchange rate started trading at 1,368.0 won, down 8.5 won from the previous trading day.

Detailed domestic gold prices can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/ Reporter Joo Hong-chul jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com

▶ 디지털 뉴스 콘텐츠 이용규칙보기

2024.12.28(토) 13:02

2024.12.28(토) 13:02