|

-오늘의 금시세(한국금거래소 0.43%↓, 한국거래소-KRX 0.51%↓)

국제 금값이 역대 장중 최고치를 기록한 후 소폭 하락했다. 금가격 고점에 따른 차익실현이 금값을 끌어내렸다.

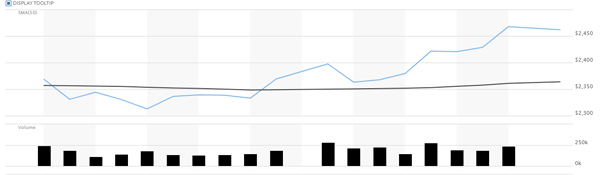

수요일(17일 현지시간) 뉴욕상업거래소에서 올해 8월물 금 선물 가격은 전거래일 대비 0.32%(7.9달러) 하락한 온스당 2,459.90달러에 거래를 마감했다.

금가격은 마감 무렵 소폭 하락했지만, 오전 한때 장중 사상 최고가를 또다시 경신했다.

이날 장중 8월물 금 가격은 온스당 2,488.40달러까지 고점을 높이며, 전날 기록한 2,474.50달러를 하루 만에 갈아치웠다.

금값이 역대 최고치로 오른 후 단기 선물 거래자들의 차익 실현에 의해 소폭 하락한 모양새다.

|

다만, 9월에 연방준비제도가 금리를 인하할 것이라는 기대감이 커지면서 달러가 약세를 보이며 금가격 하락폭을 제한했다.

이날도 미국 연방준비제도(Fed·연준) 주요 인사들은 머지않은 미래에 기준금리 인하가 필요하다고 잇달아 발언하고 나섰다. 최근 금리 인하가 가까워졌다고 시사한 제롬 파월 연준 의장과 보조를 맞추는 모습이다.

존 윌리엄스 뉴욕 연방준비은행 총재는 외신과의 인터뷰에서 "미국 고용시장이 점점 냉각되고 있고 지난 3개월간의 물가상승률 지표는 우리가 찾고 있는 디스인플레이션 추세가 더 가까워지고 있다는 것을 보여준다"며 "이는 긍정적인 신호들"이라고 말했다.

그러면서 그는 "인플레이션이 우리 목표치인 2%까지 지속가능한 수준으로 가고 있다는 자신감을 얻기 위해 더 많은 지표를 보고 싶다"고 말했다.

크리스토퍼 월러 연준 이사도 현재 미국 경기가 연착륙 과정에 있는 것 같다며 금리 인하가 타당해지는 시점이 가까워졌다고 진단했다.

그는 캔자스시티 연방준비은행 주최로 열린 행사에서 "우리가 아직 최종 목적지에 도착했다고 생각하진 않는다"면서도 "잠재적인 시나리오들을 검토해보면 금리 인하 시점이 가까워지고 있다"고 말했다.

시카고상품거래소(CME) 페드워치툴에 따르면 연방기금금리 선물시장은 이날 마감 무렵 9월 금리 인하 확률을 98.1%로 반영했다.

중앙은행의 금리 인하는 이자가 붙지 않는 금을 보유하는 기회 비용을 감소시키는 금의 긍정적인 요인이다.

주요 6개 통화에 대한 달러 가치를 반영하는 달러 인덱스는 약 0.5% 하락해 4개월 만에 최저치에 근접하며 금값을 지지했다.

High Ridge Futures의 대체 투자 및 거래 이사인 데이비드 메거는 "연준의 금리 인하가 가까워지고 있다는 기대감과 달러화 약세가 금값 상승의 주요 지지 요인이다”고 설명했다.

기타 금속 중 은값은 3.7% 하락해 온스당 30.21달러에 거래를 마쳤다. 플래티넘은 0.4% 하락해 996.30달러를 나타냈고, 팔라듐은 0.5% 하락한 953.93달러를 기록했다.

이 시각 국제 금값시세(오전 9시 50분 기준, 런던 LBMA 금값시세)는 2,459달러 선에 움직이고 있다.

전날 사상 최고치를 기록했던 국내 금가격도 소폭 내렸다.

18일 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.43%(2000원) 하락한 460,000원(VAT포함)이다(오전 9시 50분 기준).

소비자가 순금 1돈 팔때 가격은 전장과 같은 402,000원이다. 18k, 14k 팔때 가격도 각각 295,500원, 229,200원으로 전 거래일과 비슷한 수준이다(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일 대비 2.2% 하락한 5,9910원, 팔때는 2.34% 내린 4,700원을 기록했다. 백금 살때 가격은 전일보다 1.04% 내린 192,000원, 팔때 가격은 0.64% 하락한 156,000원이다.

한국거래소(KRX)와 신한은행 금가격은 g당 10만9천원 안팎에 거래됐다.

한국거래소(KRX) 금값은 전일 종가 대비 0.51% 하락한 g당 109,210원을 나타내고 있다(오전 9시 50분 기준).

신한은행 금시세는 0.13%(136.41원) 내린 108,876.41원을 기록했다.

서울 외환시장에서 원·달러 환율은 전 전거래일보다 2.3원 내린 1379원에 거래 출발했다.

자세한 국내 금시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/주홍철 기자 jhc@kjdaily.com

-다음은 위 기사를 영어로 번역한 전문이다. 번역에 오류가 있을 수 있다.

- International gold price on the 17th 0.32%↓

- Today's gold price (Korea Gold Exchange 0.43%↓, Korea Exchange-KRX 0.51%↓)

The international gold price fell slightly after hitting an all-time intraday high. Profit taking due to the high gold price dragged down the gold price.

On Wednesday (local time on the 17th), the price of gold futures for August this year closed at $2,459.90 per ounce, down 0.32% ($7.9) from the previous trading day at the New York Mercantile Exchange.

The gold price fell slightly toward the end of the day, but at one point in the morning, it renewed its intraday all-time high.

The intraday price of gold for August reached a high of $2,488.40 per ounce, breaking the previous day's record of $2,474.50 in one day.

The price of gold has fallen slightly after reaching an all-time high due to profit-taking by short-term futures traders.

However, as expectations grow that the Federal Reserve will cut interest rates in September, the dollar has weakened, limiting the decline in gold prices.

On this day, key figures from the US Federal Reserve (Fed) have repeatedly stated that a base rate cut is necessary in the near future. They are in step with Fed Chairman Jerome Powell, who recently suggested that a rate cut is imminent.

In an interview with foreign media, New York Federal Reserve Bank President John Williams said, "The US job market is cooling down, and the inflation rate indicators for the past three months show that the disinflationary trend we are looking for is getting closer," adding, "These are positive signals."

He added, "I would like to see more indicators to gain confidence that inflation is on track to our sustainable 2% target."

Federal Reserve Governor Christopher Waller also said that the U.S. economy appears to be in the process of a soft landing and that the time has come for a rate cut to become reasonable.

At an event hosted by the Federal Reserve Bank of Kansas City, he said, “I don’t think we’ve reached our final destination yet,” but “if we look at potential scenarios, the time for a rate cut is getting closer.”

According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the federal funds futures market reflected a 98.1% probability of a rate cut in September at the close of the day.

The central bank’s rate cut is a positive factor for gold, as it reduces the opportunity cost of holding gold that does not pay interest.

The dollar index, which reflects the value of the dollar against six major currencies, fell about 0.5%, nearing its lowest level in four months, supporting gold prices.

David Meagher, director of alternative investments and trading at High Ridge Futures, explained, "Expectations that the Fed is getting closer to cutting interest rates and the weak dollar are the main support factors for the rise in gold prices."

Among other metals, silver prices fell 3.7% to close at $30.21 per ounce. Platinum fell 0.4% to $996.30, and palladium fell 0.5% to $953.93.

At this time, the international gold price (as of 9:50 a.m., London LBMA gold price) is moving around $2,459.

Domestic gold prices, which hit an all-time high the previous day, also fell slightly.

According to the Korea Gold Exchange on the 18th, when consumers buy 1 don (24k, 3.75g) of pure gold, the price fell 0.43% (2,000 won) compared to the previous day. It is 460,000 won (including VAT) (as of 9:50 AM).

When consumers sell 1 don of pure gold, the price is 402,000 won, the same as the previous day. The prices for 18k and 14k are 295,500 won and 229,200 won, respectively, which are similar to the previous trading day (the product price is applied when buying 18k and 14k).

In addition, the price for silver when buying fell 2.2% from the previous trading day to 5,9910 won, and the price for selling fell 2.34% to 4,700 won. The price for platinum when buying fell 1.04% from the previous day to 192,000 won, and the price for selling fell 0.64% to 156,000 won.

The price of gold on the Korea Exchange (KRX) and Shinhan Bank is around 109,000 won per gram. was traded.

The gold price on the Korea Exchange (KRX) is showing 109,210 won per gram, down 0.51% from the previous day's closing price (as of 9:50 a.m.).

Shinhan Bank's gold price was recorded at 108,876.41 won, down 0.13% (136.41 won).

In the Seoul foreign exchange market, the won-dollar exchange rate started trading at 1,379 won, down 2.3 won from the previous trading day.

Detailed domestic gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/ Reporter Joo Hong-chul jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com

▶ 디지털 뉴스 콘텐츠 이용규칙보기

2024.12.26(목) 10:43

2024.12.26(목) 10:43